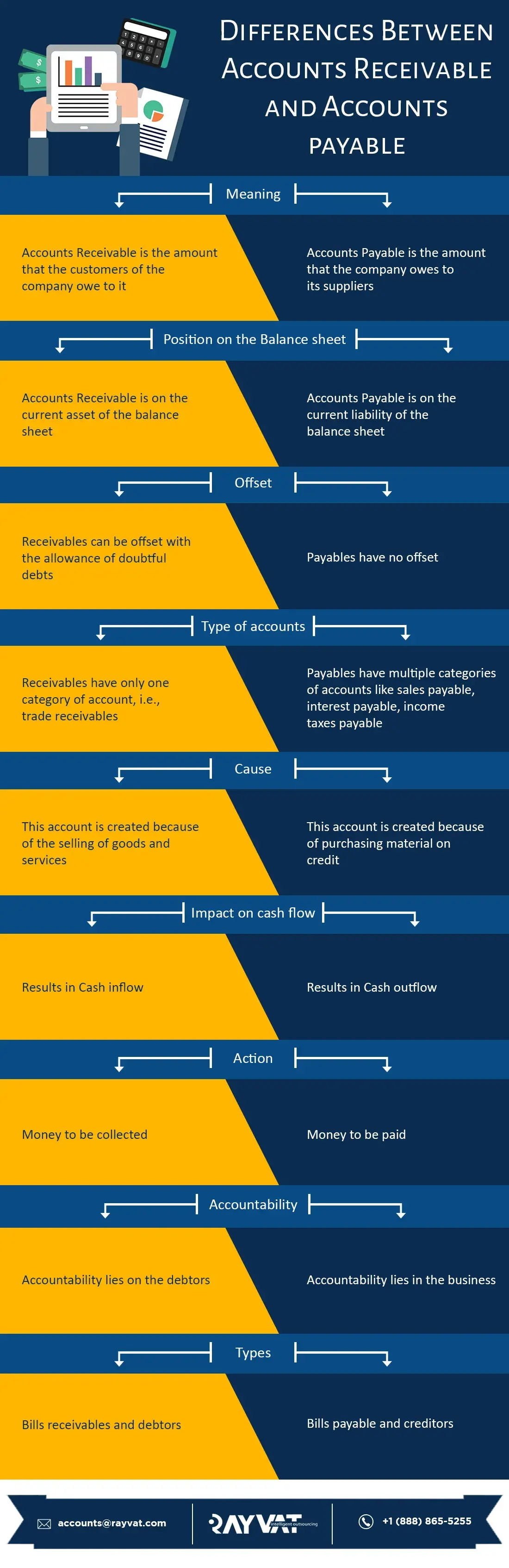

Accounts receivable and accounts payable are different for several reasons. From a legal perspective to an accounting perspective. Assets are the amounts that other entities people owe the corporation because of the results of the acquisition of products also as rendering services.

However, accounts payable are what the corporation owes other entities and other people after the corporation purchases goods or renders services from them.

What are Accounts Payable?

Accounts payable is a current liability account that keeps track of money that you owe to any third party. The third parties can be banks, companies, or even someone who you borrowed money from. One common example of accounts payable is purchases made for goods or services from other companies. Depending on the terms for repayment, the amounts are typically due immediately or within a short time.

What are Accounts Receivable?

Accounts receivable is a current asset account that keeps track of money that third parties owe to you. Again, these third parties can be banks, companies, or even people who borrowed money from you. One common example is the amount owed to you for goods sold or services your company provides to generate revenue.

Accounts payable and assets are ledger entries you record if you employ accrual accounting. Both accounts are recorded when revenues and expenses are incurred, not when cash is exchanged. Create an assets entry once you offer credit to your customers. Make an accounts payable entry once you purchase something on credit.

Since accounts payable and assets require double entry, you'll have to create debits and credits for every account. That helps you balance your books.

Accounts Receivable and Accounts Payable: What’s the Difference?

If you are looking for accountants near me for small businesses? That can prepare your yearly taxes. Our Certified Accountants have been helping small businesses with their online accounting such as managing Bookkeeping Services, Accounts Payable, Accounts Receivable, BAS & Financial Statements, Payroll, and Tax Return Preparation, Inventory & Cash Flow Management, etc.

Kindly contact us today for more details and a specific quote.