The Essential Guide to eCommerce Accounting

A P. and A R. - An Introduction

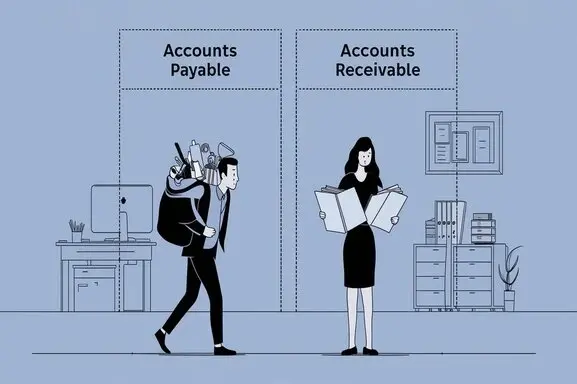

Two further crucial components of accounting, accounts payable and accounts receivable, essentially show the amount of money a business owes its suppliers or vendors (accounts payable) or the amount of money consumers owe to the company. When handling the financial condition and cash flows inside a firm, these are some of the most crucial ideas one should understand.

Define accounts payable.

A common line of credit for which a company owes money to another company for items and services acquired on credit is accounts payable. It can comprise:

Advertisement services, utility services, maintenance services, etc. are a few of the items and materials purchased from suppliers—including items in stock—part of the initial stage of production.

Goods utilized in production; installations and other equipment are bought under an installment credit arrangement.

This entails any expenses the business bears in running or otherwise in the course of the financial period that must be paid for in the future for the goods or services acquired in the past.

If a business purchases products and services on credit, it incurs a cost as the money has not yet been paid out. Still, the corporation must include those costs if it is using those products and gaining an advantage from those services. Our balance sheet shows "accounts payable" since the outstanding value has not yet been paid.

Representing short-term liabilities and other amounts payable within one year, it is one of the assets listed in the section on current assets of the corporate balance sheet. Cash balance is compromised and accounts payable obligation drops when payment is completed. Should this payment still be outstanding for one year, it is moved to the long-term debt.

Describes Accounts Receivable.

The figure related to the money clients still owe the company for goods or services acquired on a credit basis is Accounts receivable. It can comprise:

A type of service delivery whereby the services are provided to clients anticipated to pay in the future; items are sold to them on a credit basis.

In - Rent or royalty paid by other people or businesses constitutes a direct type of expense.

Regarding: the items a company entity can collect from other entities via other claims or reimbursement.

Anytime a company offers credit services or commodities, it supplies those items and services before getting paid. As so, the sale is recorded in the accounts receivable of the company until the consumer pays it for the good.

Since accounts receivable is an amount owing to the firm by its clients and the company has a right to be paid in the future, it is generally categorized as current assets. It reveals which, according to those thought to be channeled into the company via credit-based consumers. Usually, the balance of receivables decreases as the client pays for the previously acquired goods or services.

In essence, accounts payable and accounts receivable differ from one another in that the former describes money owing to a company by its suppliers, while the latter is the whole amount owing from customers to the company.

Although their sounds are similar, accounts payable and accounts receivable are rather different ideas:

Using accounts payable and accounts receivable helps one to determine what a firm has to pay and

what others have to pay a company.

Not recorded as current liability_Notated as a current asset.

rises through credit acquisition rises on credit sale.

This relates to paying for something. This relates to client payment; it is money spent, hence acquired.

Important since they help control the financial situation and cash flow of the business are accounts payable and receivable.

Since it directly determines the company's fortunes, accounts payable and receivable management greatly influence its cash flow. It solves issues including:

Cash flow disturbances resulting from delayed receipt of cash or rising receivables

Credit losses from customer unpaid payments; working capital gathered and locked in accounts receivable

Interest charges or penalties resulting from delayed vendor payments; lack of stocks stemming from budget cuts leading to high accounts payable;

Understanding when payments are due, sending timely invoices and chasing customers for payments, deciding credit terms with suppliers, assessing customer creditworthiness before sales, and prioritizing payables in line with payment terms and conditions are the main key issues to consider while managing AP and AR.

Reports, measurements, and the use of accounts receivable and Accounts payable personnel and accounts software all point to this area of business being made effective. Days Sales Outstanding and Days Payable Outstanding are two crucial instruments that evaluate the company's payable and receivable management performance.

While supplier relationships, payments consolidation, and AP automation improve payables management, efficiencies such as lockbox processing services help the early collection of receivables. These provide working capital faster, efficiency, and let one take advantage of early payment savings from suppliers.

Consequently, some of the most important tools for evaluating data with unpaid balances and credit-standing with other trade partners are accounts payable and accounts receivable. The effective financial management and attainment of solid cash flows of any company depend much on careful evaluation of these ideas and application of best practices concerning AR and AP.

Contact us here for Accounting services now!