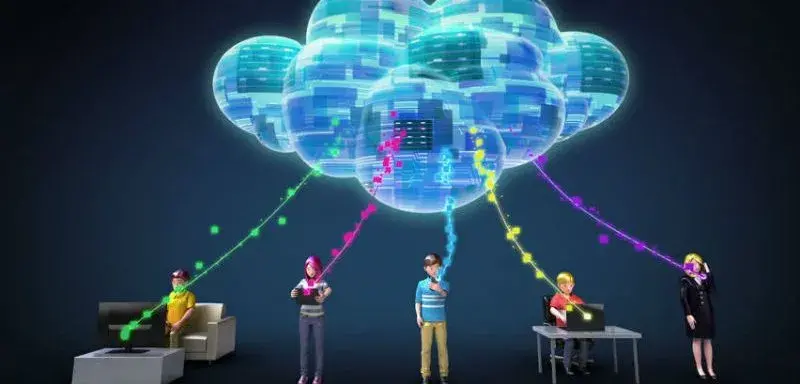

In the era of cloud computing, and remote operations, the majority of the work would move from onsite to the virtual environment. This would also result in work being transferred across borders in order to gain from the cost advantages between Eastern and Western countries.

It has been almost a decade since Information Technology work (like software development, and web development) has moved to the virtual world leaving back the barriers of location.

It is the beginning of a new era for cross-border accountancy just like the Information Technology Sector.

However, there are challenges for Accounting Sector which need to be addressed. Some of them are:

a) Network security

Bringing the data on the network can have increased the risk of eavesdropping and compromise on confidentiality of client information

b) Knowledge Expertise

Accountants have specialized knowledge of certain definite national laws and regulations. In order to go cross the border, new expertise has to be gained.

c) Legal requirements

SOX and other regulations have stringent requirements for Virtual Accounting services-related work.

d) Professional and ethical conduct of accountants.

Local regulations of the CPAs govern the professional and ethical conduct of the accountants.

e) Managing Cultural Diversities and knowledge of International Laws

There might be a communication gap due to different cultures.

I would like to invite members’ comments who hold any view regarding cross-border transfer of work.